hotel tax calculator bc

If you make 52000 a year living in the region of British Columbia Canada you will be taxed 13446. 2022 free British Columbia income tax calculator to quickly estimate your provincial taxes.

Amazon Com Check Correct Function Desktop Calculator Auto Replay Business New Model Cx 950 Tax Calculator Office Products

Hotels in most parts of BC will be 15 5 GST 8 PST short term.

. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions. Calculate the total income taxes of the British Columbia residents for 2022. Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax.

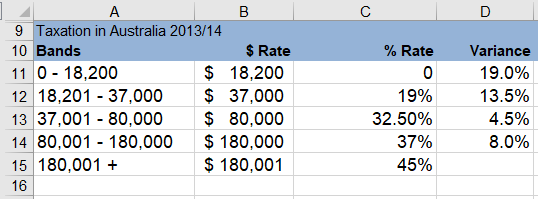

British Columbias marginal tax rate. In 2022 British Columbia provincial government increased all tax brackets and base amount by 21 and tax rates are the same as previous year. The maximum MRDT rate is 3.

Hotel owners operators or managers must collect state hotel occupancy tax from their guests who rent a room or space in a hotel costing 15 or more each day. Amount without sales taxes x PST rate100 Amount of PST in BC Amount without sales tax GST amount PST amount Total amount with sales tax Example 50 x 5100 250 GST. Income Tax 765887 EI Premiums 790 CPP Contribution 253425 After Tax Income 3901688 Average Tax Rate 1532 Marginal Tax Rate 282 Best 5-Year Variable.

Provincial Sales Tax PST In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed. The british columbia annual tax calculator is updated for the 202223 tax year. Some communities such as Downtown Victoria have an.

Including the net tax income after tax and the percentage of tax. To increase the rate in their area participating. The period reference is from january 1st 2022 to.

To calculate the subtotal amount and sales taxes from a total. Base amount is 11302. 2021 Income Tax Calculator Canada.

The tax applies not only to. The state hotel occupancy tax rate is 6. If you make 52000 a year living in the region of Ontario Canada you will.

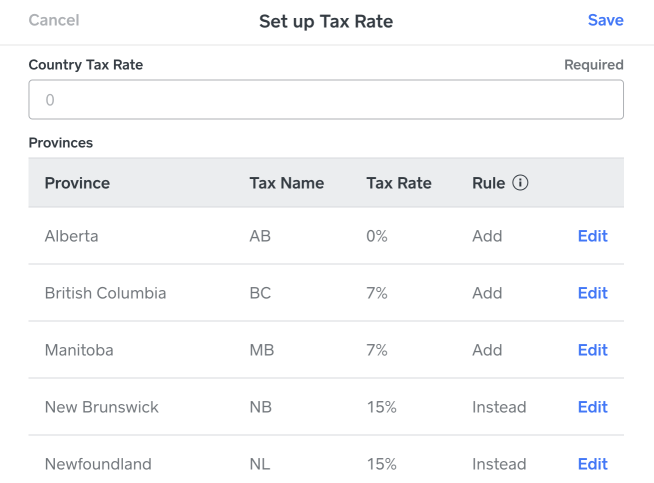

GST 5 PST 7 on most goods and services 2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts Select hotels in Vancouver levy an additional. Your tax per night would be 1950. Their tax rates see MRDT Participating Municipalities Regional Districts and Eligible Entities below.

GSTHST provincial rates table The following table provides the GST and HST provincial rates. Provincial sales tax pst bulletin. Use this calculator to find out the amount of tax that applies to sales in Canada.

Calculate the total income taxes of the British Columbia residents for 2021. That means that your net pay will be 38554 per year or 3213 per month. The tax rates in British Columbia range from 506 to 205 of income and the combined federal and provincial tax rate is between 2006 and 535.

Gst On Real Estate Purchase Rates Rebates Exemptions Bridgewell

Vancouver Real Estate Commission Calculator Realtor Fees Bc 2022

Netherlands Corporate Income Tax Calculator 2022 Odint Consulting

How To Calculate Canadian Sales Tax Gst Hst Pst Qst 2020 Sage Advice Canada English

10 Tax Tips For Airbnb Homeaway Vrbo Vacation Rentals Turbotax Tax Tips Videos

How To Configure Woocommerce Tax Settings Learnwoo

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

How To Calculate Income Tax In Excel

Billionaire S Association With Luxury B C Mansion Highlights Property Tax Loophole Cbc News

Create Tax Rates Weebly Support Us

Billionaire S Association With Luxury B C Mansion Highlights Property Tax Loophole Cbc News

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

3 Methods To Calculate Your Gst Sharon Perry Associates Cpa

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

The Real Cost Of Buying Luxury Cars In B C Dmcl

Climate Action Tax Credit Province Of British Columbia