free crypto tax calculator australia

Crypto Tax in Australia - The Definitive 20212022 Guide. Australian Dollars triggers capital gains tax.

![]()

Cointracking Crypto Tax Calculator

Crypto Tax Calculator who we recommend for our existing users.

. Selling cryptocurrency for fiat currency eg. Australian citizens have to report their capital gains from cryptocurrencies. Because of the current inflow of crypto traders looking for to diversify.

Possibility sector fund QOZF which include 10-year tax-unfastened boom. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. 50 Capital Gains Tax discount.

We have long been committed to offering the most compliant and easy to use crypto platform. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on. This service which is completely free enables users to generate well-organized crypto tax reports which can then be downloaded for tax filing.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while. CoinLedger - Best crypto tax software overall. Calculate Your Crypto DeFi and NFT Taxes in Minutes.

Koinly - Lowest cost at 41 AUD with our 30 discount link CoinTracker. This means you can get your books. Compliant with Australian tax rules.

If you only buy and hold then you dont need to pay tax on your crypto even if the value of your purchased coins. Capital gains tax report. Affordable plans for everyone.

Youll only start to pay Income Tax when you hit 18200 in total income per year. Buy BTC and ETH at Bitget and begin your crypto trading journey now. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you.

Ad Bitget is the leading crypto exchange platform for crypto derivatives trading. Australias Leading Crypto Tax Tool. File your crypto taxes in Australia.

Coinpanda generates ready-to-file forms based on. Were excited to expand our free-to-use crypto tax reporting service to Australia. You simply import all your transaction history and export your report.

June 27 2022. If you hold your cryptocurrency for. Aggregate Your Exchange Data.

Australian Cryptocurrency Record Keeping Made Simple. Seize the perfect opportunity of BTC bottom fishingDont miss the perfect time. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes.

At Crypto Tax Calculator Australia we believe plans and pricing should be affordable no matter how much you are trading or the amount of transactions you. For example lets say Sam bought 1 bitcoin BTC for A5000 five years ago. Quick simple and reliable.

The tax rate on this particular bracket is 325. Crypto tax platforms can help in ways to calculate your capital gains track Bitcoin prices at specific datestimes for personal income tax returns and company transaction reporting. A capital gains event only occurs when you do something with your crypto.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. TokenTax - Supports data from every exchange and wallet. Dont have an account.

Ad Short sell BTC for great profit kucoin Exchange by your side. Ill talk this kind of asset class. Introduction Investing in cryptocurrency can be rewarding but it is important to recognise that there are differences between crypto.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

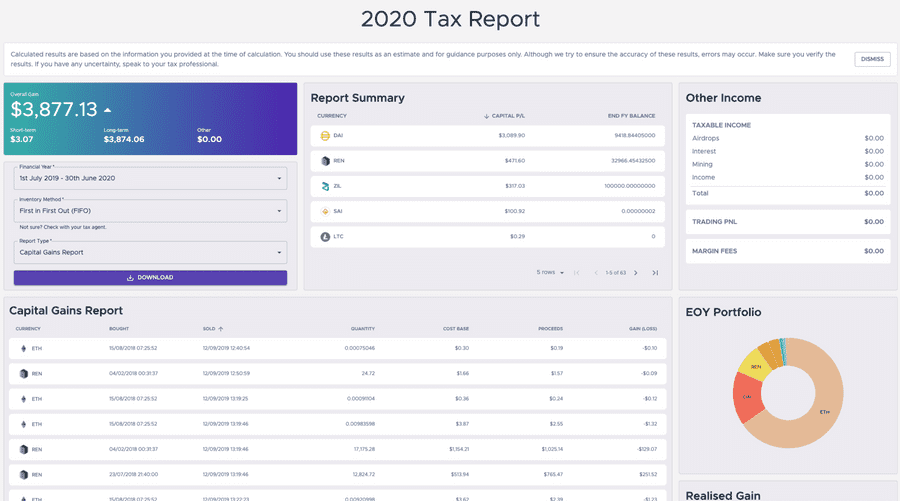

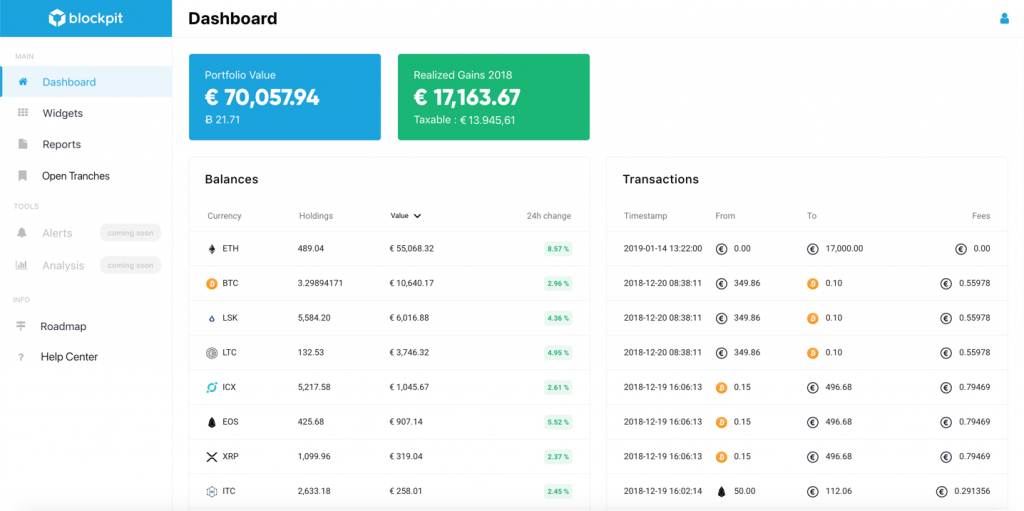

Crypto Tax Calculator 2021 Platform Review

Malta Based Stasis Launches New Euro Backed Stablecoin Euro Bitcoin Bitcoin Price

Calculate Your Crypto Taxes With Ease Koinly

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Bitcoin Price Prediction Today Usd Authentic For 2025

Crypto Tax Calculator 2021 Platform Review

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda